Biometric Payments in 2025: How Face and Fingerprint Tech Are Replacing Cards and Cash

Table of Contents

Introduction

The future of payments is becoming contactless, seamless, and cardless — all thanks to biometric technology. From unlocking your phone with Face ID to authorizing a payment with your fingerprint, biometrics are quickly becoming the go-to method for secure and frictionless transactions.

In 2025, biometric payments are moving from a futuristic concept to a mainstream reality across banking, retail, and e-commerce. With enhanced security, faster authentication, and growing consumer trust, the days of swiping a card or entering a PIN might soon be over.

What Are Biometric Payments?

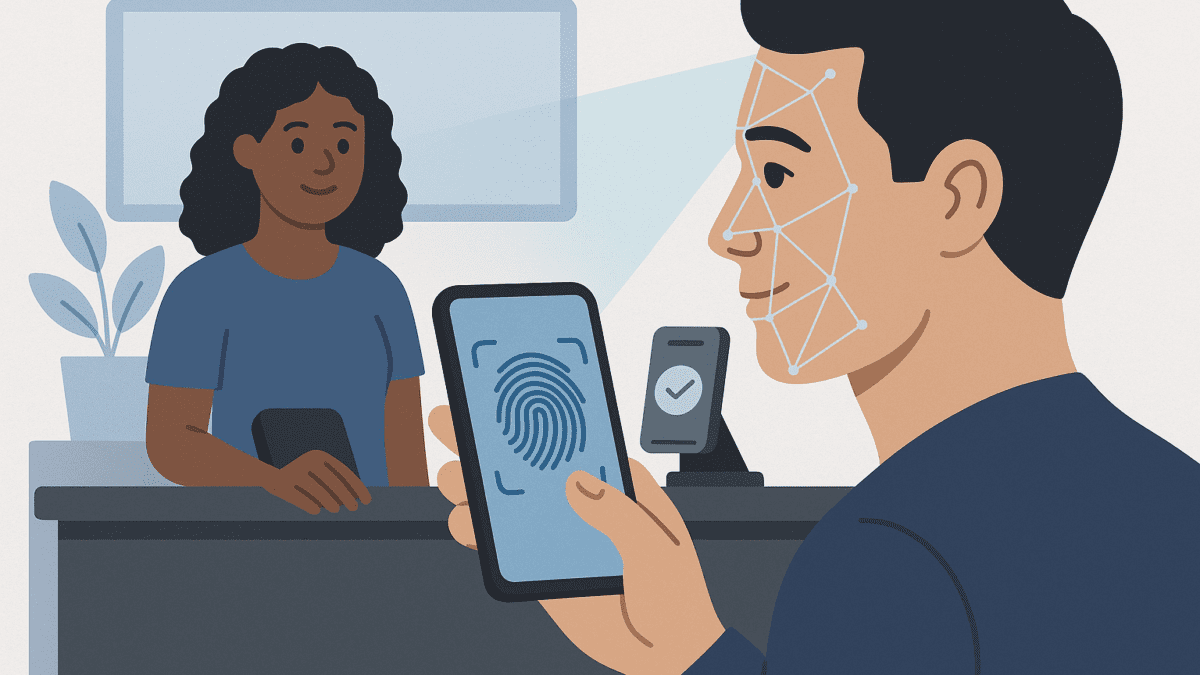

Biometric payments use unique biological characteristics — such as your fingerprint, facial structure, or iris scan — to verify your identity and authorize transactions.

Instead of carrying physical cards or remembering passwords, your body becomes your key to payment systems. This method is powered by advanced sensors, AI-driven recognition software, and secure data encryption.

Why 2025 Is the Tipping Point for Biometric Payments

Several factors have aligned to make 2025 the year biometric payments gain mass adoption:

- Advancements in AI Recognition Technology – Near-zero false positives and faster matching speeds.

- Integration Across Banking Systems – Major banks and payment networks now support biometric authentication.

- Post-Pandemic Hygiene Awareness – Consumers prefer touch-free transactions.

- Global Push for Security – Biometric systems make fraud and identity theft harder to execute.

Popular Types of Biometric Payments in 2025

- Fingerprint Recognition: The most widely used biometric payment method. From smartphones to POS systems, fingerprint sensors enable fast authentication.

- Example: Apple Pay, Samsung Pay, and various banking apps use fingerprint scanning to approve payments.

- Facial Recognition: High-resolution cameras paired with AI algorithms identify customers in seconds.

- Example: Alipay’s “Smile to Pay” service in China lets users pay by simply looking at a camera.

- Iris and Retina Scans: Used in high-security environments, these methods are now entering retail and ATM systems.

- Voice Recognition: Emerging as a niche option for smart speaker-based transactions and call center payments.

Benefits of Biometric Payments

- Enhanced Security – Your biometric data is unique and much harder to replicate than passwords or PINs.

- Faster Checkout Experience – No fumbling for wallets or devices.

- Fraud Reduction – Limits the ability of cybercriminals to use stolen card details.

- Increased Convenience – Works seamlessly across multiple platforms and devices.

Real-World Examples of Biometric Payments in 2025

- Mastercard’s Biometric Checkout Program – Lets customers pay with their face or palm.

- Amazon One – Palm-scanning payment system in physical retail stores.

- HSBC Voice ID – Allows banking transactions over the phone with voice authentication.

Challenges and Concerns

While biometric payments offer clear benefits, they also raise questions:

- Privacy Risks – Storing biometric data must be handled with extreme care to avoid breaches.

- Cost of Implementation – Hardware like high-resolution cameras and advanced sensors can be expensive.

- Regulatory Hurdles – Compliance with global data protection laws (GDPR, CCPA) is essential.

The Future of Biometric Payments

By 2030, experts predict that over 60% of all global transactions will be authenticated biometrically. With the rise of AI-driven fraud detection, improved data encryption, and wearable payment devices, the future may see a complete shift away from physical payment instruments.

We may also see a multi-biometric approach, combining facial, fingerprint, and behavioral biometrics to create even stronger authentication layers.

How Businesses Can Prepare

- Upgrade POS Systems – Invest in biometric-enabled payment terminals.

- Train Staff – Ensure teams can assist customers using biometric systems.

- Communicate Security Measures – Build consumer trust by being transparent about how biometric data is stored and protected.

- Integrate With Existing Digital Wallets – Make adoption seamless for customers already using Apple Pay, Google Pay, or Samsung Pay.

Conclusion

In 2025, biometric payments are not just a convenience — they’re becoming a competitive advantage. By combining speed, security, and customer experience, businesses adopting biometric payment methods will be well-positioned to thrive in the evolving financial landscape.

Boost your B2B pipeline with our expert WhitePaper Lead Generation services — start driving high-quality leads today.

See Also: Lead Quality vs. Lead Quantity: What B2B Marketers Are Getting Wrong in 2025