Chargebee raises $250M to meet the growing demand from subscription businesses

Table of Contents

Introduction

A pioneering subscription management platform, Chargebee’s announced that it has closed major funding of $250 million. The latest funding found was led by Sequoia Capital and Tiger Global. The round also included participation from previous investors, including Insight Partners and Steadview Capital.

Chargebee’s last funding found was in April 2021 when it raised $125 million at a valuation of $1.4 billion. The total investment in the company is $470 million.

According to UBS financial services firm, the subscription economy is expected to grow to $1.5 trillion by the year 2025, which will double its current $650 billion estimates.

Chargebee to use funds towards innovation

As more businesses become or are conceived as recurring revenue businesses, the opportunity for Chargebee’s global customer base increases. Funds from the latest investment round will be used for product innovation as well as global expansion. This will support the revenue and billing needs of the future and existing subscription businesses, in addition to strategic corporate growth initiatives.

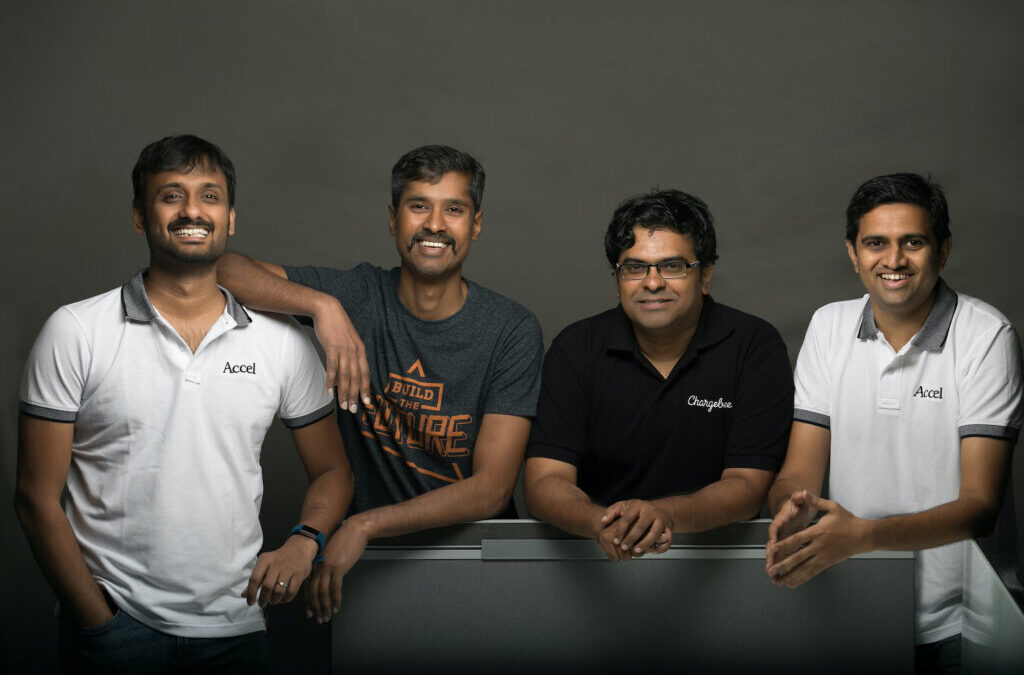

CEO and co-founder of Chargebee, Krish Subramanian said “We built Chargebee to solve infrastructure issues facing high-growth subscription businesses with a product roadmap laser-focused on replacing in-house systems orchestrating the complex parts of revenue intelligence like billing and payments.

As subscription offerings continue to rapidly evolve, our focus remains on providing a flexible growth engine to power, capture and understand revenue, all in real-time.” Subramanian added that the latest round of funding is to drive innovation to empower the next generation of businesses that will leverage subscription billing models to start, scale, and transform quickly.

Tejeshwi Sharma, MD, Sequoia India said that Sequoia believes that, in the future, every company will be a subscription company. Sharma added that the predictability of a subscription business model is extremely attractive, and Chargebee is a leading revenue management partner for the subscription economy.

The platform of Chargebee offers its customers a real-time 360-degree view into revenues and user behaviour and the intelligence which can be used to quickly adapt and make better business decisions. Sequoia’s investment reflects the growing market need and belief in the Chargebee team.

See Also: Apple submits its plan for an alternative payment system in South Korea

About Chargebee

Chargebee is one of the most popular and reliable subscription management platforms that’s focused on automating revenue operations of more than 4,000 subscription-based companies – from startups to enterprises. The SaaS platform aids subscription-model businesses across verticals, which include SaaS, e-learning, eCommerce, IoT, and Publications.

It also helps in managing and growing revenue by automating subscription, payments, billing, invoicing, and revenue recognition operations and provides all the necessary including key metrics, reports, and business insights. Founded in 2011, Chargebee’s global customer base includes big brand names, like Freshworks, Okta, Calendly, and Study.com.

To build a unified revenue management platform, the company has recently increased its offerings by conducting strategic acquisitions RevLock (the leaders in revenue recognition) and Brightback (the leader in churn deflection and retention). Chargebee also expanded its presence globally by adding new offices and investments in India and Australia and partnerships with GoCardless, PayPal, Salesforce, and HubSpot.

Conclusion

Chargebee’s recent funding of $250 million will fuel its innovation and expansion, reinforcing its position as a leader in the subscription management space. With a rapidly growing subscription economy and an increasing global customer base, Chargebee aims to continue enhancing its platform to support the evolving needs of businesses with recurring revenue models. The company’s focus on product innovation and global expansion will help it scale further and provide cutting-edge solutions to subscription-based businesses, solidifying its role as a key player in the future of the subscription economy.

FAQs

- What is Chargebee’s recent funding round amount?

Chargebee raised $250 million in its latest funding round, bringing its total investment to $470 million. - Who led Chargebee’s recent funding round?

Sequoia Capital and Tiger Global led the recent funding round, with participation from previous investors like Insight Partners and Steadview Capital. - How does Chargebee support subscription-based businesses?

Chargebee automates revenue operations for subscription businesses, including billing, payments, invoicing, and revenue recognition. It provides real-time insights and analytics to help businesses make better decisions. - What will Chargebee use the new funds for?

The funds will be used for product innovation, global expansion, and supporting the revenue and billing needs of subscription businesses. - Which industries does Chargebee cater to?

Chargebee serves various industries, including SaaS, e-learning, eCommerce, IoT, and publications, helping businesses automate subscription and revenue management. - What acquisitions has Chargebee made recently?

Chargebee acquired RevLock, a leader in revenue recognition, and Brightback, a leader in churn deflection and retention. - Which big companies use Chargebee’s platform?

Chargebee’s customer base includes major brands like Freshworks, Okta, Calendly, and Study.com.

For more latest IT news and updates, keep reading iTMunch