Pixpay is a challenger bank for teens centered on pocket money

Table of Contents

Introduction

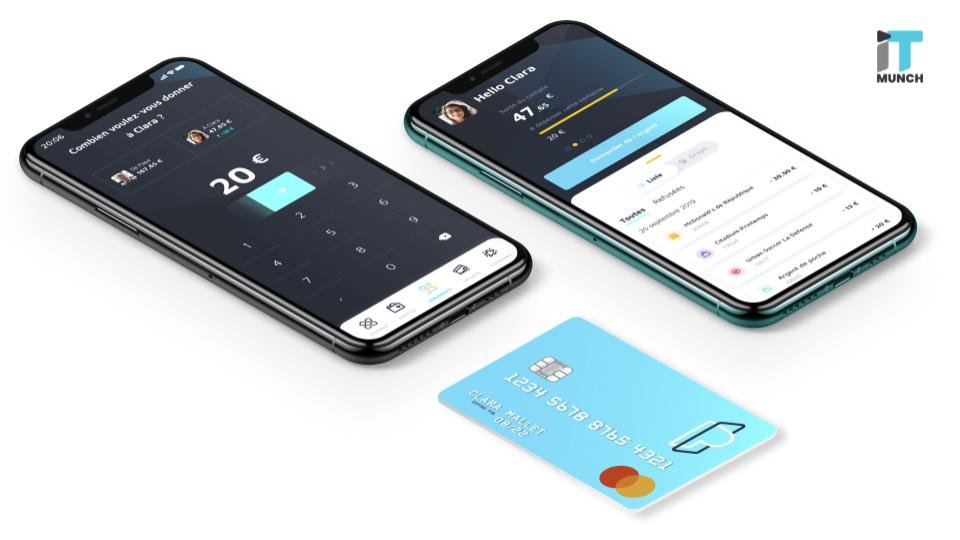

Meet Pixpay, a French startup that aspires to replace cash when you are giving out pocket money to your children.

Anybody that is more than ten years old can create a Pixpay account, receive a debit card, and handle pocket money.

The Introduction to Challenger Banks

Challenger banks are nothing unique, but they are still often targeted towards adults.

If you need to create an N26 or Revolut account, you have to be a minimum of 18 years old.

You can open a Lydia account if you are at least 14 years old with parental approval.

Pixpay, like Kard, desires to fill that gap and give the latest payment methods to teens so that you can leave cash altogether.

Parents and children both can download the Pixpay app to communicate with the service.

A few days after opening an account, your child gets a Mastercard.

It gives the same features that you would assume from a challenger bank.

You can change the PIN code, lock it, and unlock it, get a notification with each transaction and modify some features, such as limits, ATM withdrawals, online payments, and payments overseas.

Pixpay additionally lets you create virtual cards for online payments.

In addition to a few spending analytics, users can design projects and set money aside to purchase a costly thing after months of savings.

Parents can also set an interest rate on a safe account to educate children on how to save money.

In the future, Pixpay desires to allow teens to accumulate money after a babysitting job, for example.

SEE ALSO: Now anyone can create maps and stories on Google Earth

The Involvement of Students

As for parents, they can transfer money directly from the Pixpay app.

Parents can view a summary of various accounts in case you have many children using Pixpay.

Ultimately, the startup wants to let both the parents handle the account of their child, which can be beneficial for separated couples.

Pixpay charges users €2.99 per month per card.

The startup has allocated $3.4 million (€3.1 million) from Global Founders Capital.

Conclusion

Pixpay is paving the way for a new era in financial independence for teens, giving them access to modern payment methods while maintaining parental oversight. This innovative service helps bridge the gap between traditional pocket money systems and the digital financial tools used by adults. With features like virtual cards, savings goals, and real-time notifications, Pixpay not only makes managing money easier for children but also teaches them about budgeting and saving. As the service continues to grow, it could become a crucial part of teaching financial literacy to the younger generation, empowering them to navigate the future of digital finance.

FAQs

- What is Pixpay?

Pixpay is a French startup offering a financial service for children over 10 years old. It provides a debit card and app for managing pocket money, helping kids learn to save and spend responsibly. - How old do you have to be to use Pixpay?

Anyone over the age of 10 can create a Pixpay account, receive a debit card, and start managing their pocket money. - What features does Pixpay offer?

Pixpay offers features like transaction notifications, spending limits, virtual cards for online purchases, savings goals, and even a safe account with interest rates for teaching financial literacy. - How much does Pixpay cost?

Pixpay charges €2.99 per month per card. - Can parents track their children’s spending on Pixpay?

Yes, parents can monitor their child’s account through the Pixpay app, with options for setting transaction limits, tracking spending, and transferring money directly. - How does Pixpay help children learn to save?

Pixpay offers tools like savings goals, where children can set money aside for future purchases, and provides interest rates on safe accounts to encourage saving.

For more updates and the latest tech news related to Finance, Marketing, Human Resources, Artificial Intelligence, and startups, keep reading iTMunch