Revolut Review 2025: Is This Fintech Platform Worth It?

Table of Contents

Introduction

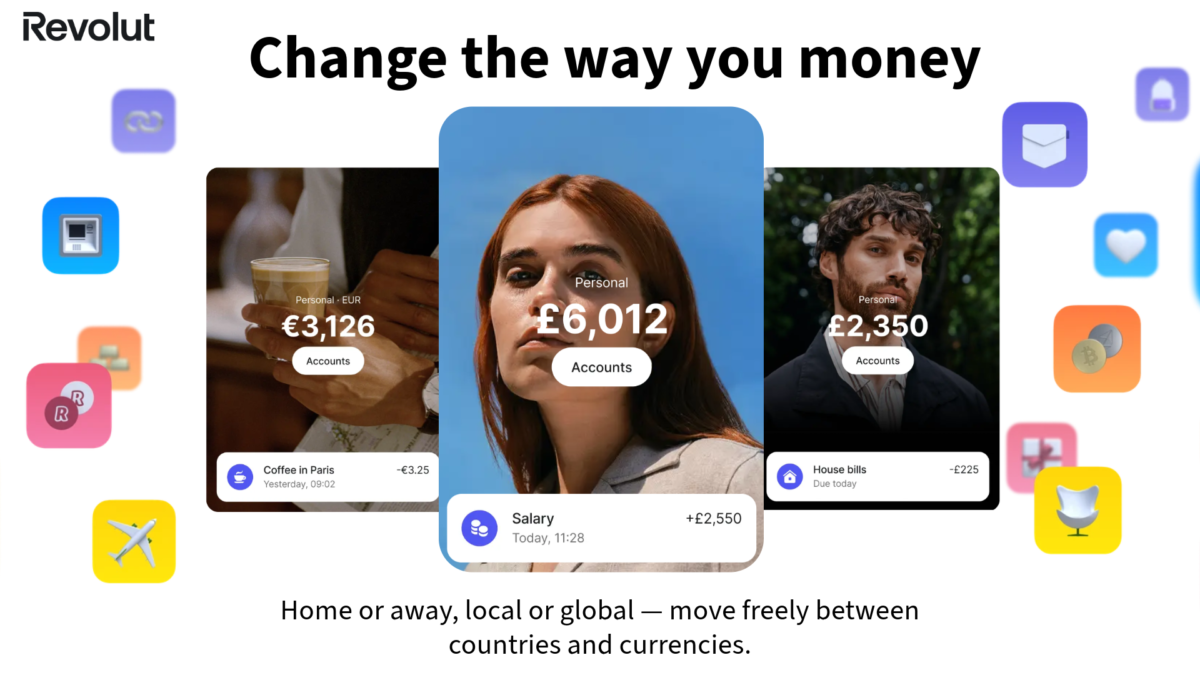

Revolut is a leading fintech platform offering digital banking services, international money transfers, cryptocurrency trading, and budgeting tools. Founded in 2015, it has grown into a popular choice for individuals and businesses seeking an alternative to traditional banking.

With its user-friendly mobile app, competitive exchange rates, and fee-free spending abroad, Revolut has disrupted the financial industry. But is it the right choice for you? This Revolut review covers Revolut’s features, pros and cons, pricing, security, and customer support to help you decide.

Key Features

1. Multi-Currency Accounts

- Hold and exchange money in over 30 currencies.

- Get real-time exchange rates with no hidden fees.

- Spend internationally with a Revolut card without extra charges.

2. International Money Transfers

- Send and receive payments globally at interbank exchange rates.

- Low-cost cross-border transactions compared to traditional banks.

3. Cryptocurrency Trading

- Buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and more.

- Convert crypto to fiat currency within the app.

- Access automated trading features.

4. Budgeting & Analytics

- Set monthly spending limits and track expenses.

- Get real-time spending insights categorized by merchants and types.

- Save money with Revolut’s automated round-up feature.

5. Subscription Plans

- Standard (Free) – Basic features with limited withdrawals.

- Plus (£2.99/month) – Extra security and customization.

- Premium (£6.99/month) – Travel insurance and enhanced exchange limits.

- Metal (£12.99/month) – Cashback, higher withdrawal limits, and exclusive perks.

6. Security & Fraud Protection

- Instant card freezing and unfreezing via the app.

- Secure encryption for transactions and account data.

- AI-driven fraud detection and real-time notifications.

Pros & Cons

Pros:

✅ Low Fees on International Transactions – Competitive exchange rates with minimal charges.

✅ Easy to Use – Intuitive mobile app with seamless financial management.

✅ Crypto & Stock Trading – Access digital asset investments within a single fintech platform.

✅ Strong Security – Advanced fraud detection and instant card controls.

✅ Multiple Account Options – Flexible subscription plans to suit different needs.

Cons:

❌ Limited Customer Support – No 24/7 phone support; reliance on chatbots.

❌ No Physical Branches – Fully digital banking experience may not suit everyone.

❌ ATM Withdrawal Limits – Free withdrawals are capped based on subscription plans.

How Does Revolut Compare to Traditional Banks?

| Feature | Revolut | Traditional Banks |

| Account Fees | Free & paid plans | Monthly maintenance fees |

| Foreign Transactions | Low fees & real exchange rates | High markup & fees |

| Crypto & Stock Trading | Available | Limited or none |

| Customer Support | Chat & email | Branch & phone |

| Security | Advanced digital encryption | Traditional banking security |

Is it Safe?

Revolut is authorized by the Financial Conduct Authority (FCA) in the UK and follows strict financial security regulations. Funds are safeguarded, and transactions are protected through advanced encryption and multi-factor authentication (MFA). However, Revolut is not a traditional bank, meaning deposits are not covered by the Financial Services Compensation Scheme (FSCS).

For extra security, users can set spending limits, disable online transactions, and freeze cards instantly within the app.

Who Can Benefit from This Digital Banking Service?

- Frequent travelers who need a multi-currency card with low exchange fees.

- Digital nomads and remote workers looking for easy international payments.

- Cryptocurrency investors seeking a simple crypto trading platform.

- Budget-conscious individuals who want detailed spending insights.

- Businesses in need of cross-border financial management.

However, if you require in-person banking or 24/7 phone support, traditional banks may be a better option.

Final Verdict:

Revolut is a game-changer in the fintech space, offering cost-effective international transactions, budgeting tools, and investment options. Its flexible pricing plans make it accessible to both casual users and power users. However, limited customer support and ATM withdrawal caps may be drawbacks for some.

For those seeking a modern, digital-first banking experience, Revolut is a strong contender. If you rely on in-person banking, you may want to explore traditional options.

Ready to Try ?

Sign up today and explore the future of digital banking! Join Revolut Now

FAQs

1. Is this a real bank?

Revolut operates under an e-money license but is not a fully licensed bank in most countries. However, it is regulated and follows strict financial laws.

2. Does Revolut charge hidden fees?

No, Revolut provides transparent pricing. However, premium services and withdrawals beyond the free limit may incur charges.

3. Can I use Revolut without a subscription?

Yes, the Standard Plan is free and includes essential banking services.

4. How long do Revolut transfers take?

Most transactions are instant, but international bank transfers can take 1-2 business days.

You May Also Like: 7 Tips for a Better Payroll Management System