5 Insanely Useful FinTech Apps You’ll Wish You Found Sooner

Table of Contents

Introduction

In 2025, managing your finances is no longer about spreadsheets or waiting in line at a bank. FinTech apps are changing the game, making it easier to save, invest, spend, and plan smarter. Whether you’re a busy professional, a budding investor, or someone who simply wants more control over your money, the right FinTech tools can make all the difference.

Here’s our list of 5 insanely useful FinTech apps you’ll wish you discovered sooner — and why they’re taking the financial world by storm.

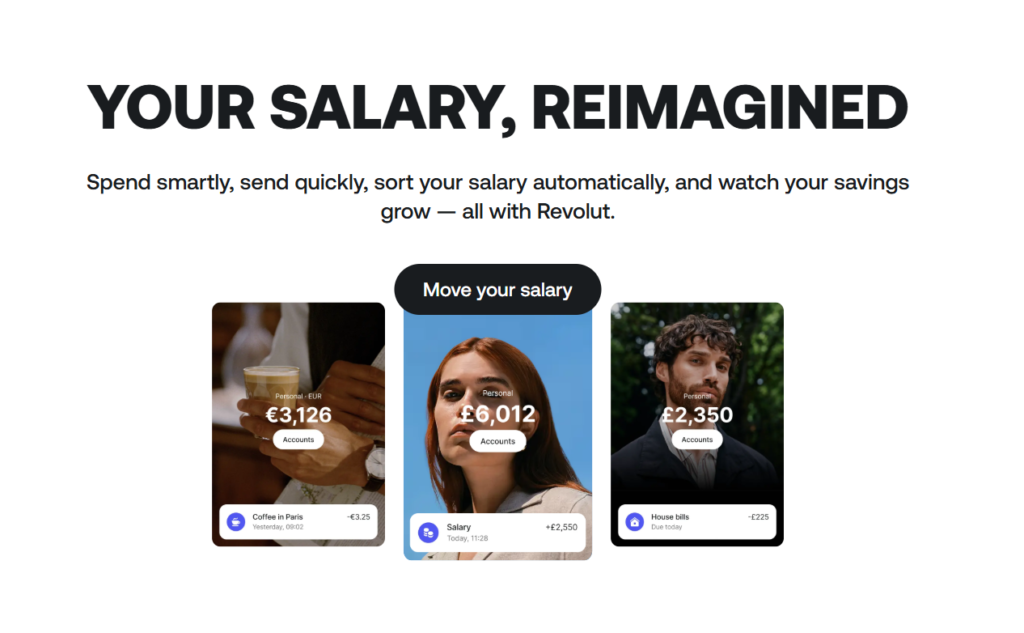

Revolut — The All-in-One Money Super App

Revolut has evolved beyond just a digital wallet — it’s become a money super app in 2025.

✅ Key features:

- Instant international payments at near interbank rates

- Built-in budgeting tools that track your spending across categories

- Commission-free stock, crypto, and commodities trading

- Smart savings vaults with round-up options

✅ Why you’ll love it:

Revolut eliminates the need for multiple apps. From currency exchange to investment and insurance, everything lives in one place — with advanced fraud protection built in.

Robinhood — Investing Made Effortless

Robinhood remains a favorite for both beginners and seasoned investors who want easy, commission-free trading.

✅ Key features:

- Zero-commission trades for stocks, ETFs, and crypto

- AI-powered investment insights tailored to your risk profile

- Automated dividend reinvestment

- Fractional shares so you can invest with small amounts

✅ Why you’ll love it:

Robinhood demystifies investing. The app’s clean interface, learning modules, and AI suggestions help you make informed decisions with confidence.

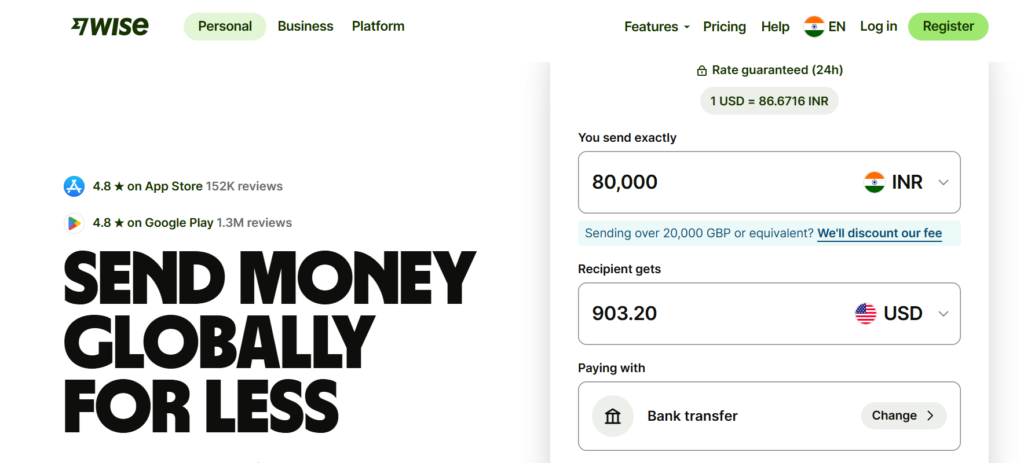

Wise (formerly TransferWise) — Borderless Banking

If you deal with international payments, Wise is a must-have in 2025.

✅ Key features:

- Low-cost global money transfers at real exchange rates

- Multi-currency accounts to hold and spend in 50+ currencies

- Business-friendly invoicing and batch payment tools

- Transparent fees — no hidden markups

✅ Why you’ll love it:

Wise helps freelancers, businesses, and expats manage cross-border payments without getting stung by traditional bank fees.

Mint — Your Personal Finance Manager

Mint remains one of the best apps for tracking your financial life in one place.

✅ Key features:

- Real-time syncing of bank accounts, credit cards, loans, and investments

- Personalized budgeting and bill reminders

- Free credit score monitoring

- Smart alerts for unusual spending

✅ Why you’ll love it:

Mint gives you a clear snapshot of your finances, helping you stay on top of bills, savings goals, and credit health effortlessly.

Chime — The Future of No-Fee Banking

Chime has redefined digital banking in 2025, offering a fee-free, mobile-first alternative to traditional banks.

✅ Key features:

- No monthly fees or minimum balance requirements

- Get paid up to two days early with direct deposit

- Automatic savings features (round-ups, % of paycheck)

- Fee-free overdraft protection up to a set limit

✅ Why you’ll love it:

Chime makes everyday banking fairer, faster, and friendlier — with great customer support and no sneaky charges.

What Makes These FinTech Apps So Powerful?

✅ Ease of use: Simple interfaces make managing money less intimidating.

✅ Transparency: Clear fees, real-time tracking, and smart alerts help build trust.

✅ Speed: Instant payments, fast transfers, and quick approvals beat traditional financial institutions.

✅ Access: From small investors to digital nomads, these apps open financial tools to everyone.

Final Thoughts: Upgrade Your Financial Life in 2025

These 5 FinTech apps aren’t just trendy — they’re practical tools that empower you to control, grow, and protect your money in 2025. Whether you want to save smarter, invest with confidence, or simplify cross-border payments, there’s an app that fits your needs.

👉 Stay tuned to iTMunchfor more insights on FinTech innovations, tools, and strategies that can future-proof your financial journey.