Table of Contents

Introduction

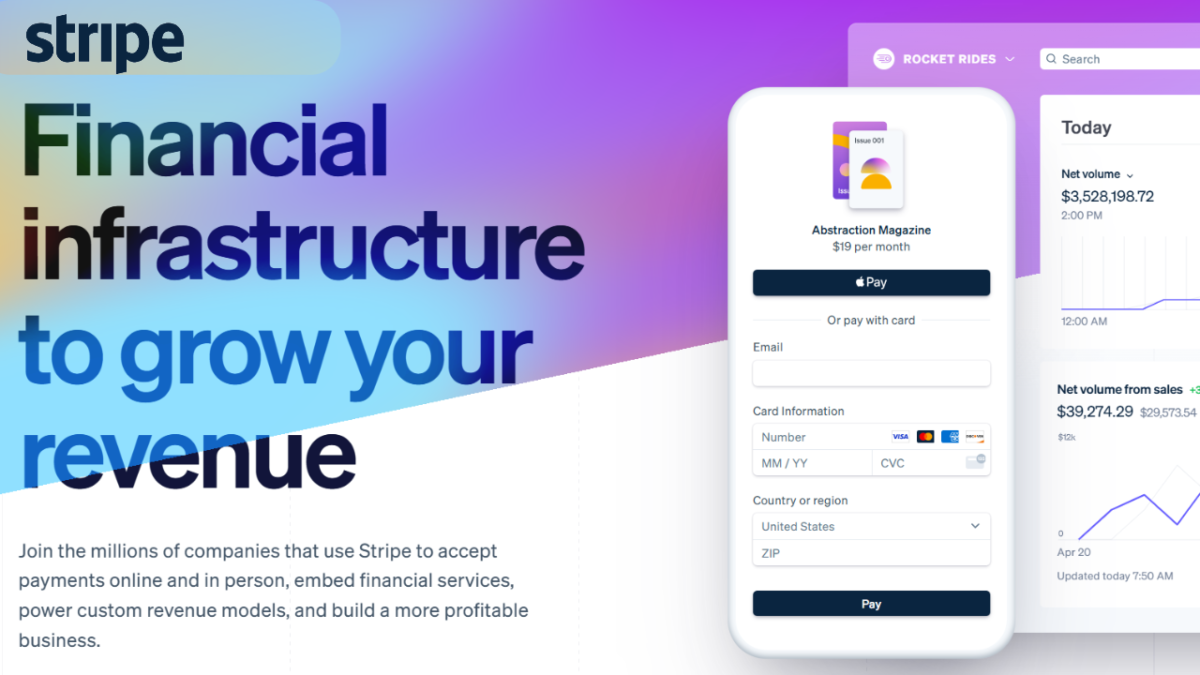

Stripe has established itself as one of the most innovative fintech platforms, providing businesses with a seamless payment processing experience. Whether you run a startup, an e-commerce store, or a large enterprise, Stripe offers powerful financial tools that simplify online transactions. This blog explores how Stripe works, its key features, and why businesses worldwide rely on it to power their payments.

What is Stripe?

Founded in 2010, Stripe is a financial technology company that provides a suite of payment solutions for online businesses. With a focus on ease of use, security, and global scalability, Stripe enables companies to accept payments, manage subscriptions, and streamline financial operations with minimal friction. Its developer-friendly API makes integration smooth, making it a top choice for businesses looking to scale efficiently.

Key Features

- Seamless Payment Processing

- Accepts a wide range of payment methods, including credit/debit cards, digital wallets (Apple Pay, Google Pay), and bank transfers.

- Supports more than 135 currencies, enabling global transactions.

- Quick setup with minimal technical expertise required.

- Powerful APIs for Customization

- Developer-friendly API allows businesses to integrate Stripe seamlessly into websites and apps.

- Custom checkout experiences tailored to brand needs.

- Webhooks for real-time transaction updates and automation.

- Subscription & Recurring Billing

- Stripe Billing automates invoicing and subscription management.

- Advanced features like metered billing and proration ensure flexible pricing models.

- Supports dynamic pricing and customizable invoicing.

- Security & Compliance

- PCI-DSS Level 1 compliance ensures the highest level of payment security.

- Built-in fraud detection with Stripe Radar, leveraging machine learning to prevent fraudulent transactions.

- Strong authentication mechanisms, including 3D Secure for additional security layers.

- Global Expansion Capabilities

- Supports local payment methods across different regions, enhancing accessibility.

- Multi-currency support with automatic currency conversion.

- Enables businesses to expand internationally without complex financial infrastructure.

- Financial & Revenue Management

- Stripe Treasury provides banking-as-a-service for seamless financial management.

- Real-time analytics and revenue reporting for better decision-making.

- Integrated Tax Compliance

- Stripe Tax automatically calculates and collects sales tax, VAT, and GST based on location.

- Ensures compliance with tax regulations in multiple jurisdictions.

- Simplifies tax reporting and reduces the burden of manual calculations.

Why Businesses Choose Stripe

Businesses across industries prefer Stripe for its reliability, flexibility, and advanced features. Here’s why:

- E-commerce & Marketplaces: Platforms like Shopify and WooCommerce integrate Stripe for smooth checkout experiences.

- SaaS Companies: Subscription-based businesses benefit from Stripe Billing’s automated invoicing.

- Freelancers & Small Businesses: Quick and easy setup with minimal transaction fees.

- Enterprise Solutions: Companies like Amazon, Lyft, and Zoom leverage Stripe’s scalable infrastructure.

Stripe vs. Other Payment Platforms

How does Stripe compare to competitors like PayPal and Square?

| Feature | Stripe | PayPal | Square |

| Customization | ✅ High | ❌ Limited | ✅ Moderate |

| API Integration | ✅ Yes | ❌ No | ✅ Yes |

| Subscription Billing | ✅ Yes | ✅ Yes | ❌ No |

| Fraud Prevention | ✅ Advanced | ✅ Basic | ✅ Basic |

| Global Reach | ✅ 135+ Currencies | ✅ 25+ Currencies | ❌ Limited |

Stripe stands out for its developer-friendly infrastructure and extensive global support, making it a preferred choice for scalable businesses.

Future of Stripe & Fintech Innovation

As fintech evolves, Stripe continues to innovate:

- Embedded finance: Businesses can integrate banking and lending services.

- AI-driven fraud prevention: Enhanced machine learning for security.

- Expansion into new markets: Stripe is constantly entering emerging economies to support digital payments.

Conclusion: Is Stripe Right for Your Business?

Stripe is an industry-leading payment solution designed for businesses of all sizes. Whether you need a reliable payment gateway, subscription billing, or fraud protection, Stripe offers a comprehensive suite of tools to help you grow.

If you’re looking for a scalable, secure, and globally accepted payment platform, Stripe is an excellent choice.

Call to Action

Want to integrate Stripe into your business? Sign up today and start processing payments effortlessly!

You May Also Like: Revolut Review 2025