Tokenization Beyond Finance: How Real-World Assets Are Moving On-Chain

Table of Contents

Introduction

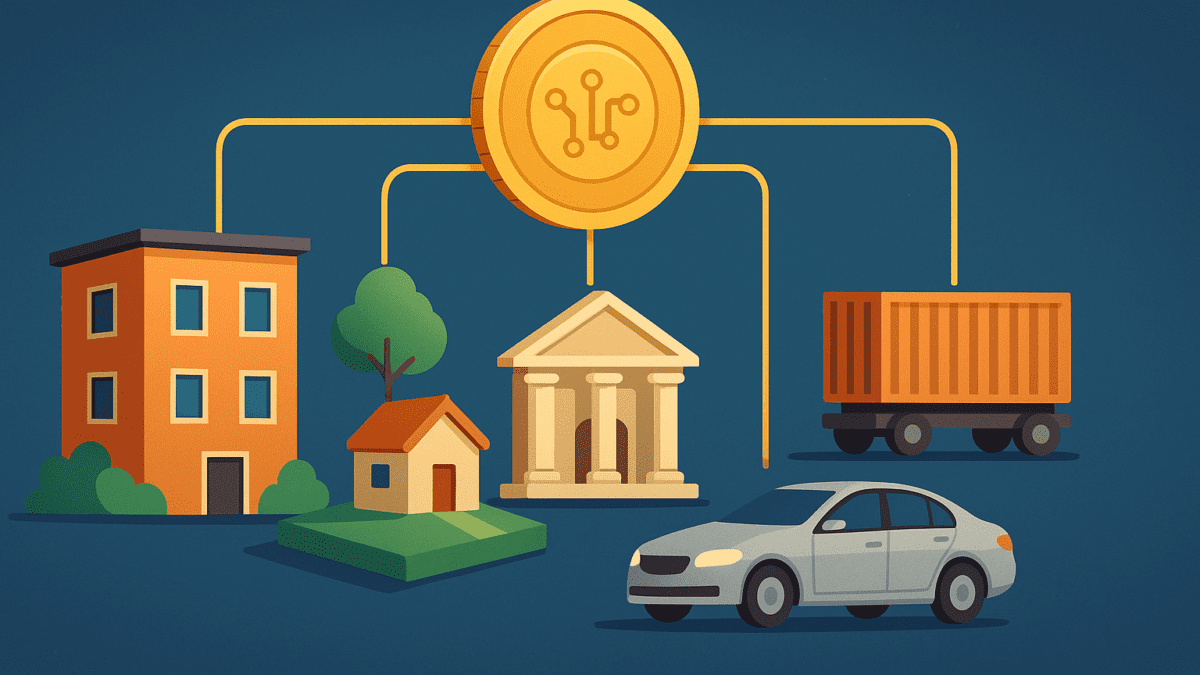

For years, blockchain has been closely tied to cryptocurrencies and decentralized finance (DeFi). But in 2025, one of the most disruptive innovations in the blockchain ecosystem is happening outside traditional finance: real-world asset (RWA) tokenization. From real estate to art, supply chains to carbon credits, tokenization is redefining how physical and intangible assets are owned, traded, and monetized.

In this blog, we’ll explore what tokenization means beyond finance, the industries being disrupted, and how it is shaping the future of digital ownership.

What Is Tokenization of Real-World Assets?

Tokenization is the process of representing ownership rights to an asset—whether physical (like property) or intangible (like patents)—as a digital token on a blockchain.

- Each token acts as a fractional representation of the asset.

- Ownership can be split among multiple investors, traded instantly, and verified transparently.

- The blockchain ensures security, traceability, and immutability of these ownership records.

In short, tokenization allows previously illiquid or inaccessible assets to become liquid, divisible, and tradable.

Beyond Finance: Industries Leading the Tokenization Wave

Real Estate

Traditionally, real estate investment requires large amounts of capital and complex legal processes. With tokenization:

- Properties can be divided into fractional tokens.

- Retail investors can own a share of prime commercial real estate with as little as a few hundred dollars.

- Transactions are faster, with fewer intermediaries.

Platforms like RealT and Brickken are already pioneering tokenized property markets.

Art and Collectibles

The art world is notoriously exclusive and illiquid. Tokenization is democratizing access by:

- Allowing collectors to buy fractions of high-value paintings.

- Enabling artists to retain royalties on secondary sales via smart contracts.

- Expanding ownership beyond physical borders, making art investment global.

This builds on the NFT movement but moves closer to regulated, asset-backed ownership.

Supply Chain and Commodities

Tokenization is improving traceability and trust in global supply chains:

- Coffee beans, diamonds, and even luxury goods can be tokenized for origin verification.

- Buyers can scan a QR code to confirm authenticity and ethical sourcing.

- Commodities like gold and oil can be traded digitally with greater transparency.

Carbon Credits and Sustainability

As ESG and climate goals rise, carbon credit markets are ripe for tokenization.

- Tokenized credits ensure verifiable emission reductions.

- They reduce fraud in carbon trading by offering transparent audit trails.

- Companies can offset emissions more easily with liquid, blockchain-based credits.

Projects like Toucan Protocol are already working on tokenized carbon assets.

Intellectual Property (IP) & Patents

IP is often underutilized because of its complexity in licensing and trading. Tokenization enables:

- Fractional ownership and investment in patents.

- Faster royalty distribution to inventors.

- A more liquid marketplace for IP assets.

This could revolutionize how startups monetize innovation.

Benefits of Tokenization Beyond Finance

- Accessibility: Retail investors can access high-value assets like luxury real estate or rare art.

- Liquidity: Assets that were once illiquid (like patents or farmland) become easily tradable.

- Transparency: Blockchain records ensure ownership and transactions are verifiable.

- Efficiency: Reduces intermediaries, lowering costs and speeding up transactions.

- Global Reach: Tokens can be traded across borders, enabling global participation.

Challenges & Risks Ahead

While promising, tokenization faces challenges:

- Regulation: Different countries have unclear or evolving laws around digital asset ownership.

- Technology Integration: Bridging physical assets with blockchain tokens securely is complex.

- Market Adoption: Enterprises and governments need to embrace tokenization for it to scale.

The Road Ahead: Mainstream Adoption in 2025 and Beyond

Analysts predict the tokenized asset market could reach $10 trillion by 2030. With pilots already running in real estate, supply chains, and sustainability, tokenization is moving beyond experiments into mainstream adoption.

For businesses, the question isn’t whether tokenization will disrupt—but when and how to prepare for it.

Conclusion

Tokenization is no longer limited to crypto traders and DeFi investors. It’s reshaping industries by turning physical and intangible assets into digital, tradable tokens. From unlocking access to real estate to powering sustainable carbon markets, tokenization is one of the most transformative innovations in the blockchain era.

If businesses want to stay ahead, now is the time to explore how tokenization can unlock new value streams in their industry.

You May Also Like: First-Party Intent Data: The Privacy-First Engine of Modern Whitepaper Marketing